hotel tax calculator bc

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. 2 Municipal and Regional District Tax MRDT on lodging in 45 municipalities and regional districts.

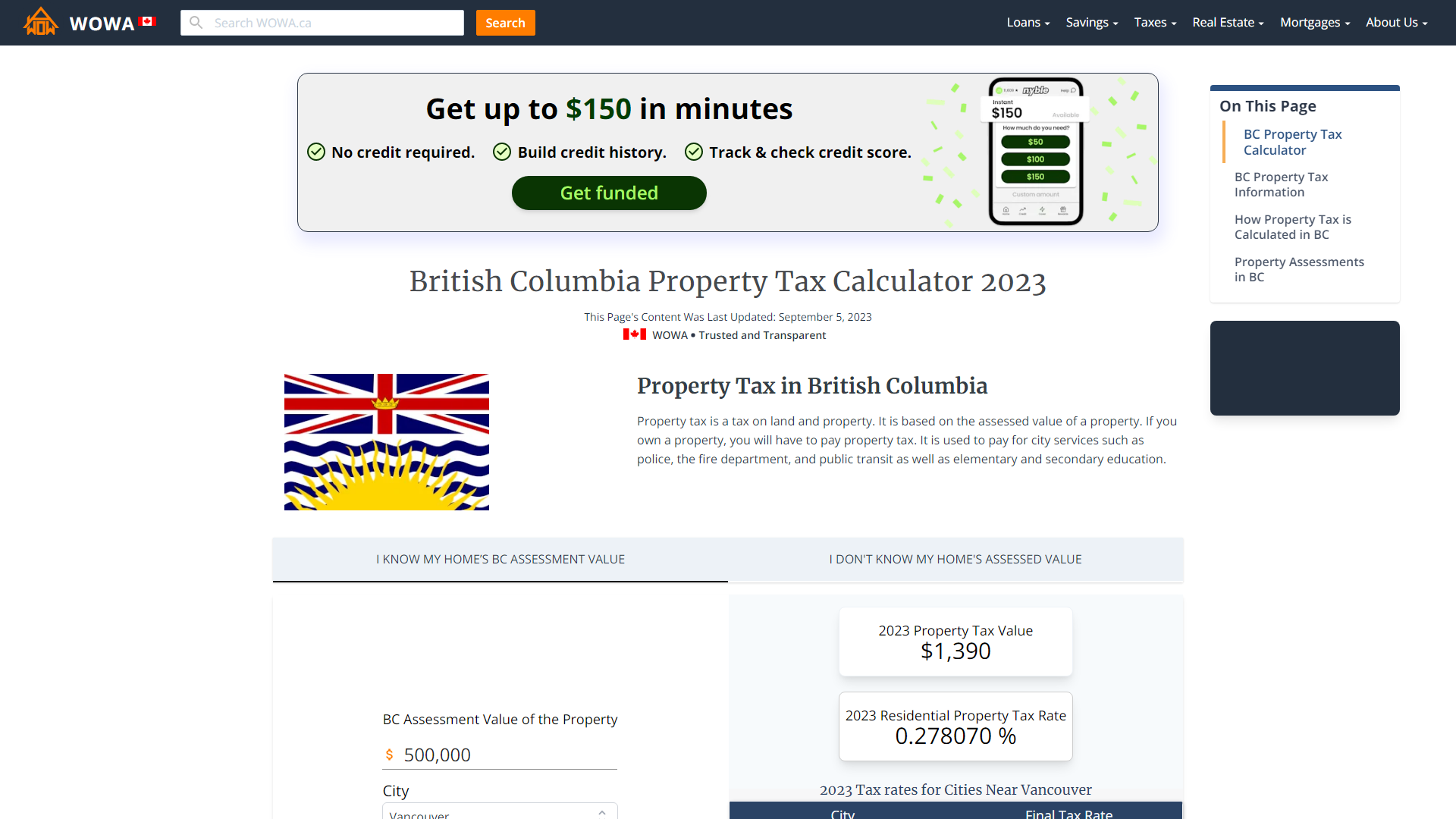

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Select the appropriate tax rates for the desired service area and property class by clicking on the box to the right.

. Destination Marketing Fee 200 x 15 300. Some communities such as Downtown Victoria have an additional Destination Marketing Fee of 10 which I believe is voluntary. 22 Accommodation includes the provision of lodging in a lodging houses boarding houses rooming houses resorts bed and breakfast establishments and similar places.

Hotels motels resorts boarding houses rooming houses and bed and breakfast establishments. 4 Specific sales tax levied on accommodations. 3 State levied lodging tax varies.

The Provincial Sales Tax PST of 7 and Goods and Services Tax GST of 5 applies to most goods and services purchased in Greater Victoria and British Columbia. This calculator should not be considered a substitute for professional accounting or legal advice. Taxable and Exempt Accommodation Definitions For the purpose of PST and MRDT.

You will then go to Screen 3 which shows the individual tax rates selected the total tax rate the assessed value input and. In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations. Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax.

Kelownas DMF may be 15. This is greater than revenue from BCs corporate income tax and property tax combined. Revenues from sales taxes such as the PST are expected to total 7586 billion or 225 of all of BCs taxation revenue during the 2019 fiscal year.

All other hotels with 81-160 rooms is 15 and 50 for hotels with more than 160 rooms. The BC homebuyer tax calculator application is a free service offered by the British Columbia Real Estate Association. The British Columbia Annual Tax Calculator is updated for the 202021 tax year.

Current GST and PST rate for British-Columbia in 2021. How much is hotel tax. Expect to be charged 12 in taxes on top of the displayed retail price.

State has no general sales tax. The Hospitality Management Calculator has a collection of equations used for hotel and restaurant management. On April 1st 2013 the government removed the HST and replaced it by provincial sales tax PST and GST in British-Columbia.

Your instalment payments are estimated to be. The Speculation and Vacancy Tax was introduced by the British Columbia government on December 31 2018 at the peak. Applies to major cities in BC including Vancouver Victoria Kelowna Nanaimo and more.

The hotel tax totals14 in most areas and inclusive of HST. MRDT 203 x 2 406. GST 5 PST 7 on most goods and services.

Hotel Room Rates and Taxes. 1 This regulation may be cited as the Hotel Room Tax Regulation. A tax rate increase will only take effect after an application has been approved by regulation.

For hotel rooms a PST of 8 GST of 5 and Municipal and Regional District Tax MRDT of 3 will be assessed. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. For every 100 dollars for a hotel rate youll pay 1496 in taxes.

Resort Fees are the most. For example if your hotel is located in Vancouver which is subject to a 2 MRDT and a 15 destination marketing fee and you provide a room in your hotel for 200 per night your guest pays. Since your employer health tax is over 292500 you are required to make quarterly instalment payments.

Any other charges are added by whatever booking agent you use. As of the time of writing this article in October 2019 the hotel tax rates are as follows. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada rate 5 for a total of 12.

Calculate your BC Vacancy Tax from your homes assessed value. Please note that campsite and RV site rentals are exempt from the Provincial Sales Tax so PST is not charged. Your instalment payments are estimated to be.

PST 203 x 8 1624. BC Revenues from Sales Taxes. The information used to make the tax and exemption calculations is accurate as of January 30 2019.

The following table provides the GST and HST provincial rates since July 1 2010. BCs Vacancy Tax can be 05 of your homes assessed value annually. Purchase Price 20000.

This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services This amount is either 18 of your earned income in the previous year or. Who the supply is made to to learn about who may not pay the GSTHST. Campsite and RV site bookings are exempt from any PST.

Hotel Room Rates and Taxes. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada rate 5 for a total of 12. Convention hotels located within a qualified local government unit with 81-160 rooms rate is 30 and 60 for hotels with more than 160 rooms.

The instalment payment due dates are. The PST for other goods and services is set at 7. Kelownas DMF may be 15.

The rate you will charge depends on different factors see. Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax. Accommodation includes lodging provided in.

Sales taxes make up a significant portion of BCs budget. Type of supply learn about what supplies are taxable or not. Some items such as food and books are exempt this tax.

8 rows Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. March 31 - Final payment with return.

Current GST and PST rate for British-Columbia in 2019. Where the supply is made learn about the place of supply rules. In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations with four or more units.

The Provincial Sales Tax for other goods. Select hotels in Vancouver levy an additional 15 Destination Marketing Fee DMF on top of the 2 MRDT which makes a total of 35 additional taxes on some accommodation in Vancouver. On April 1st 2013 the government removed the HST and replaced it by provincial sales tax PST and GST in British-Columbia.

You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax TablesUse the simple annual British Columbia tax calculator or switch to the advanced British Columbia annual tax calculator to. 21 In this regulation unless the context otherwise requires section 1 of the Act shall apply. Some communities such as Downtown Victoria have an additional Destination Marketing Fee of 10 which I believe is voluntary.

When all the rates have been selected click on any of the Calculate buttons to the right of the table.

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Tax Calculator Calculator Design Calculator Web Design

Property Tax Calculator On Sale 60 Off Www Ingeniovirtual Com

Property Tax Calculator On Sale 60 Off Www Ingeniovirtual Com

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Income Tax Calculation 2019 इनकम ट क स Calculate करन क सबस आस न तर क 2019 20 Youtube

Property Tax Calculator On Sale 60 Off Www Ingeniovirtual Com

Property Tax Calculator On Sale 60 Off Www Ingeniovirtual Com

Property Tax Calculator On Sale 60 Off Www Ingeniovirtual Com

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

British Columbia Property Tax Rates Calculator Wowa Ca

The Independent Contractor Tax Rate Breaking It Down Benzinga

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Property Tax Calculator On Sale 60 Off Www Ingeniovirtual Com

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Property Tax Calculator On Sale 60 Off Www Ingeniovirtual Com