north carolina estate tax exemption 2019

But for individuals the Tax Cuts and Jobs Act raised that to 117 million for 2021 and 1206 million for 2022. This amount can vary from year to year.

Faq Halifax County Tax Administration

No estate tax or inheritance tax.

. NC Gen Stat 28A-27-5 2019. Federal exemption for deaths on or after January 1 2023. Maryland imposes the lowest top rate at 10 percent.

A set of North Carolina homestead exemption rules provide property tax relief to seniors and people with disabilities. Application for Extension for Filing Estate or Trust Tax Return. Delaware repealed its estate tax in 2018.

Homeowners age 65 or older whose spouse is deceased can exempt up to 60000 under the homestead exemption if the property was previously owned by. This increases to 3 million in 2020 Mississippi. 2019 North Carolina General Statutes Chapter 131A - Health Care Facilities Finance Act 131A-21 - Tax exemption.

Qualifying owners must apply with the Assessors Office between January 1st and June 1st. Up from 1118 million per individual in 2018 to 114 million in 2019. 28A-27-5 - Exemptions deductions and credits.

5520 sharon view rd charlotte north carolina 28226. 16 West Jones Street. Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate jurisdiction might apply.

As of 2019 if a person who dies. North Carolina allows low-income homestead exclusions for qualifying individuals. 2019 North Carolina General Statutes Chapter 28A - Administration of Decedents Estates Article 27 - Apportionment of Federal Estate Tax.

Up to 25 cash back Update. For the year 2016 the lifetime exemption amount is 545 million. It stands at 16 million as of 2021.

This article is for the 2019 tax year. Owner or Beneficiarys Share of NC. Individual income tax refund inquiries.

North Carolina General Assembly. Previous to 2013 if a North Carolina resident died with a large estate it might have owed both federal estate tax and a separate North Carolina estate tax. Up to 25 cash back Under the North Carolina exemption system homeowners can exempt up to 35000 of their home or other real or personal property covered by the homestead exemption.

This bill will annually increase the states estate tax exemption until it matches the federal estate tax exemption of 117 million in 2023. All six states exempt spouses and some fully or partially exempt immediate relatives. Even though estate taxes are the subject of much debate and many people dont like the idea of the estate tax estate taxes affected less than 14 of 1 018 if you are keeping score of all decedents in 2015.

NC K-1 Supplemental Schedule. Art firearms historic memorabilia and other collectibles may be subject to certain taxes. The Tax Cuts and Jobs Act of 2017 doubled the unified exemption for the estate gift and GST taxes from about 56 million to about 112 million adjusted yearly for inflation.

Any federal or state gift and estate tax due however is paid by the estate during the probate of the estate. The top estate tax rate is 16 percent exemption threshold. The state exemption amount was tied to the federal one which means that for deaths in.

Effective January 1 2013 the North Carolina legislature repealed the states estate tax. The estate and gift tax exemption is 114 million per individual up from 1118 million in. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million.

Any assets in excess of the estate tax exemption are subject to estate taxes as the estate tax rates in effect as of the date of the decedents death. This dramatic change means for years after 2017 a married couple can gift during life or pass by their death up to 224 million of assets free of transfer taxes. On May 4 2011 the Connecticut estate tax exemption was retroactively decreased from 35 million back down to 2 million for deaths occurring on or after Jan.

Beneficiarys Share of North Carolina Income Adjustments and Credits. The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407 and requires the same additions and deductions. The annual gift and estate tax exemption is the dollar amount worth of gifts that you can give away in your lifetime before you have to pay an actual gift tax.

The Internal Revenue Service IRS recently announced that the estate and gift tax exemption is increasing next year. Put another way that means that you have a 998 chance of never having to worry about estate taxes. North carolina department of revenue.

An addition is also required for the amount of state local or foreign income tax deducted on the federal return. Has the highest exemption level at 568 million. The tax rate on funds in excess of the exemption amount is 40.

The Internal Revenue Service announced today the official estate and gift tax limits for 2019. After Aunt Ruths estate deducts the exemption she would only owe gift and estate taxes on the remaining 155 million taxed at the rate of 40 percent. Link is external 2021.

If you qualify you can receive an exclusion of the taxable value of your residence of either 25000 or 50 whichever is greater. The top tax rate is 16. Federal estate tax could apply as well.

If a person dies in 2019 she can. The exercise of the powers granted by this Chapter will be in all respects for the benefit of the people of the State and will promote their health and. Massachusetts has the lowest exemption level at 1 million and DC.

The current Federal Estate Tax Exemption for 2021 is 117 million per individual. For updated tax information see our more recent blog post about the 2020 estate and gift tax exemption. 2 The top tax rate is 12.

Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent. Raleigh NC 27601 919 733-4111 Main 919 715-7586 Fax. If you are totally and permanently disabled or age 65 and over and you make.

Its up to 71 million as of 2021. Current Federal Estate Tax Exemption. As of January 1st of the year for which.

NC Gen Stat 131A-21 2019 131A-21. No estate tax or inheritance tax. In 2015 the exemption increased to 15 million.

No estate tax or.

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

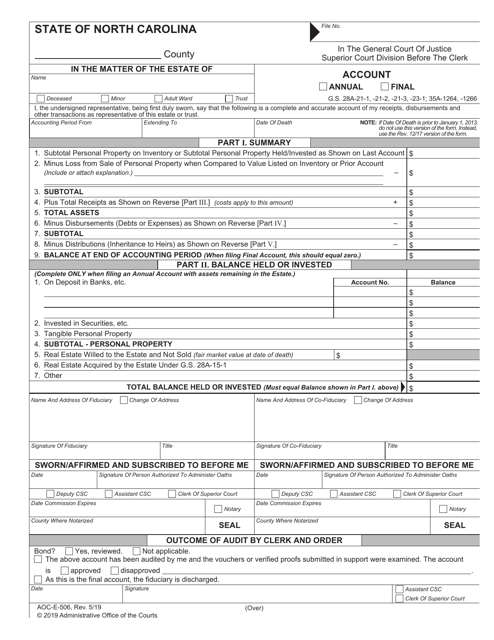

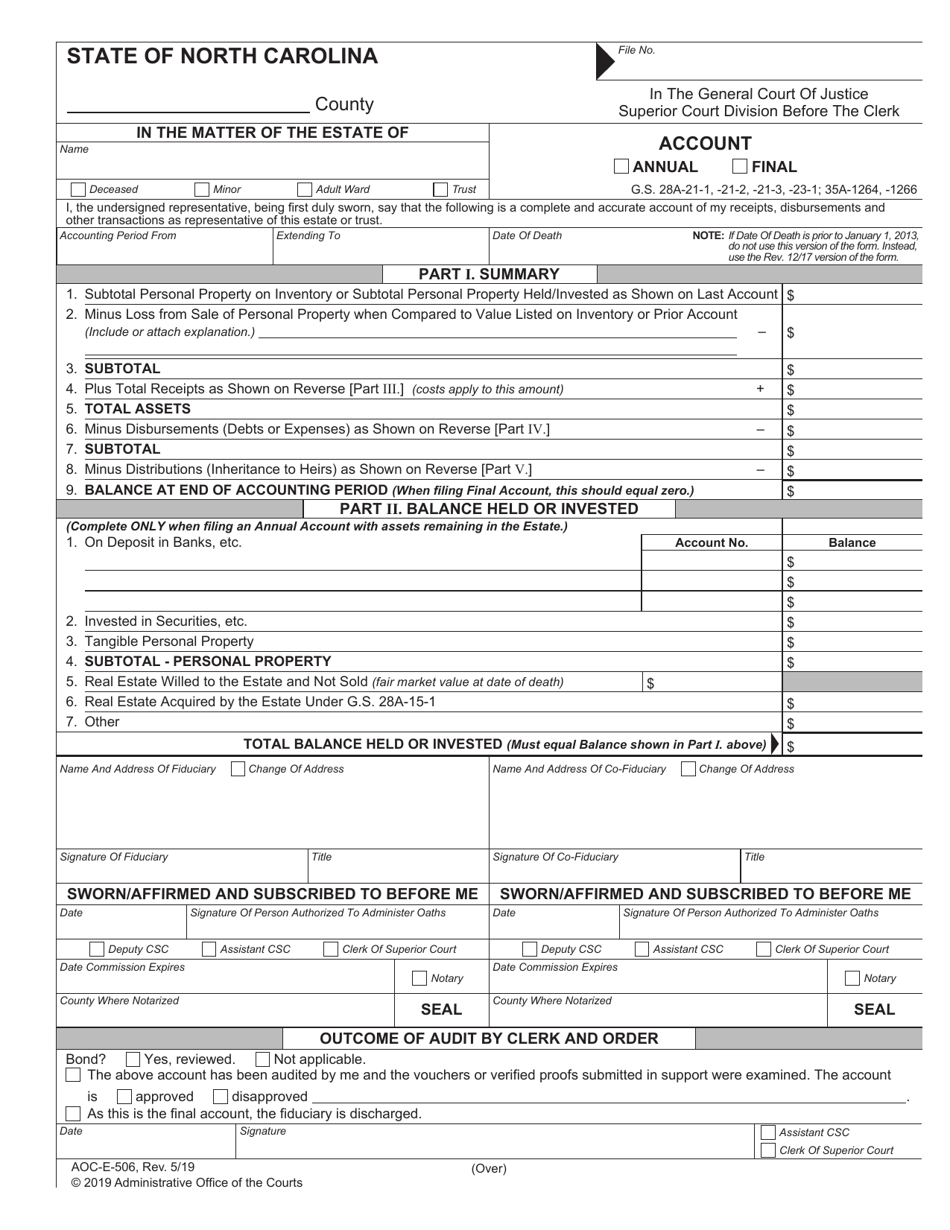

Form Aoc E 506 Download Fillable Pdf Or Fill Online Account North Carolina Templateroller

North Carolina Tax Reform North Carolina Tax Competitiveness

North Carolina Tax Reform North Carolina Tax Competitiveness

Tax Administration Duplin County Nc Duplin County Nc

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

Frequently Asked Questions Carolina Tax Trusts Estates

Moving From Maryland To North Carolina Benefits Cost How To

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Form Aoc E 506 Download Fillable Pdf Or Fill Online Account North Carolina Templateroller

North Carolina Tax Reform North Carolina Tax Competitiveness

Highlights Of North Carolina S Tax Changes

North Carolina Gift Tax All You Need To Know

North Carolina Estate Tax Everything You Need To Know Smartasset

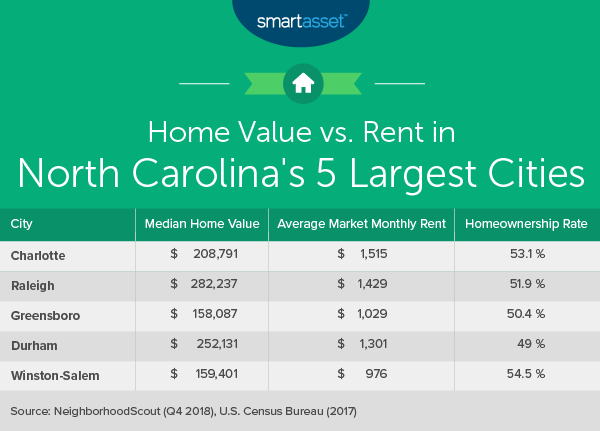

The Cost Of Living In North Carolina Smartasset

Missouri Beneficiary Deed Form Quitclaim Deed Wisconsin Gifts Transfer

North Carolina Estate Tax Everything You Need To Know Smartasset